This implies that the fee is deducted to get the gross margin. Cost of sales methodĪccounting for merchant fees as the cost of sales would place them at the top of the income statement. There are two ways you can account for merchant fees or credit card processing charges.

#Quickbooks invoice payment fees software#

Another reason you should keep track of merchant fees is that they are tax deductible.Įditor’s note: Looking for the right accounting software for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs. You should record the merchant fee and gross sales in your bookkeeping software for accurate reporting. Looking for a payment processor? Compare the merchant fees in our Square review.įor example, if you sell products worth $100 on Amazon and it charges a merchant fee of $20, you will see only $80 deposited into your bank account. When you make a sale, the merchant account deposits your sales revenue into your bank account, deducting the merchant fees from the gross sales. The fees pay for hosting, advertising, shipping, maintenance, setup and anything else involved in the sales process. Merchant fees, also called seller or transaction fees, are charged by merchant service providers to let you make a sale on their platforms.

#Quickbooks invoice payment fees how to#

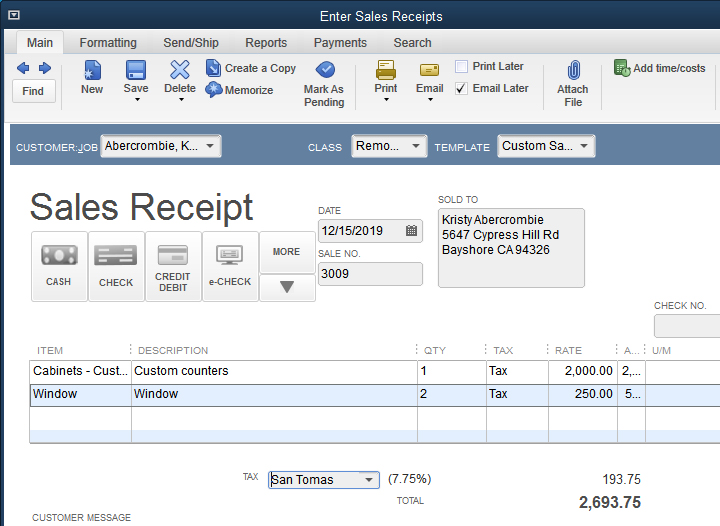

In this guide, we’ll look at how to use these features effectively on QuickBooks Online and Pro.

QuickBooks provides a straightforward solution to work with merchant fees and maintain consistent records. These fees can make up a substantial portion of your business’s cost of goods sold, making it essential to record and keep track of them, both for tax deductions and to compute gross margins. If you accept payments from customers via credit card payment processor, you will incur merchant (or transaction) fees based on the value or volume of transactions. This article is for small business owners and bookkeepers looking to make the most of what QuickBooks has to offer.Accurate reporting of merchant fees can help support decisions on choosing the right merchant accounts and sales channels.

0 kommentar(er)

0 kommentar(er)